Tax Table Under Train Law

Duterte has already signed the republic act no.

Tax table under train law. If yes then here are the applicable bir rules as regards your tax obligation under the approved train law. Eight percent 8. July 3 2018. How to compute income tax under train law to start with the computation first lets assume that your salary is 30000 per month.

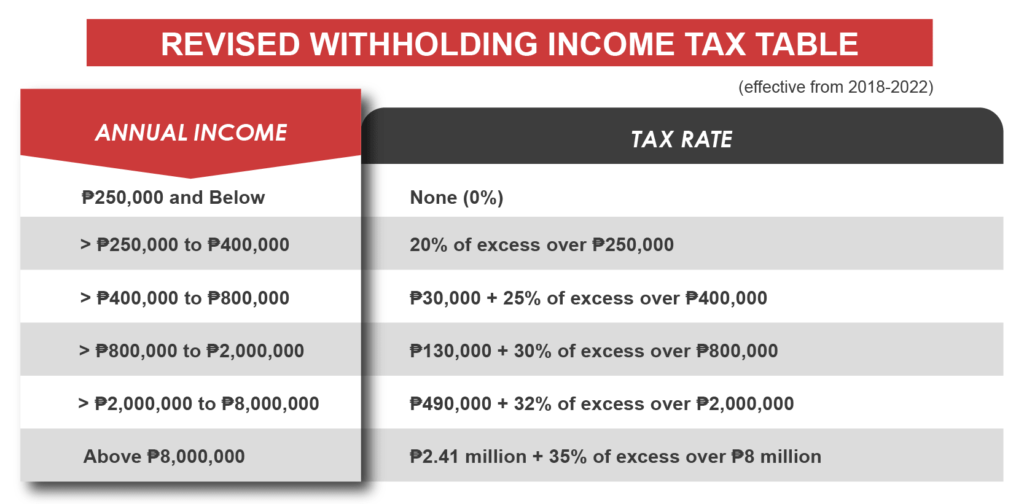

Last updated on 06062020 at 800 pm. Optional taxation for self employed and. Creates and modifies alphanumeric tax codes for individual income tax under republic act no. The train law will reduce the personal income tax rates of each individual while people earning a lower personal income will be free from tax.

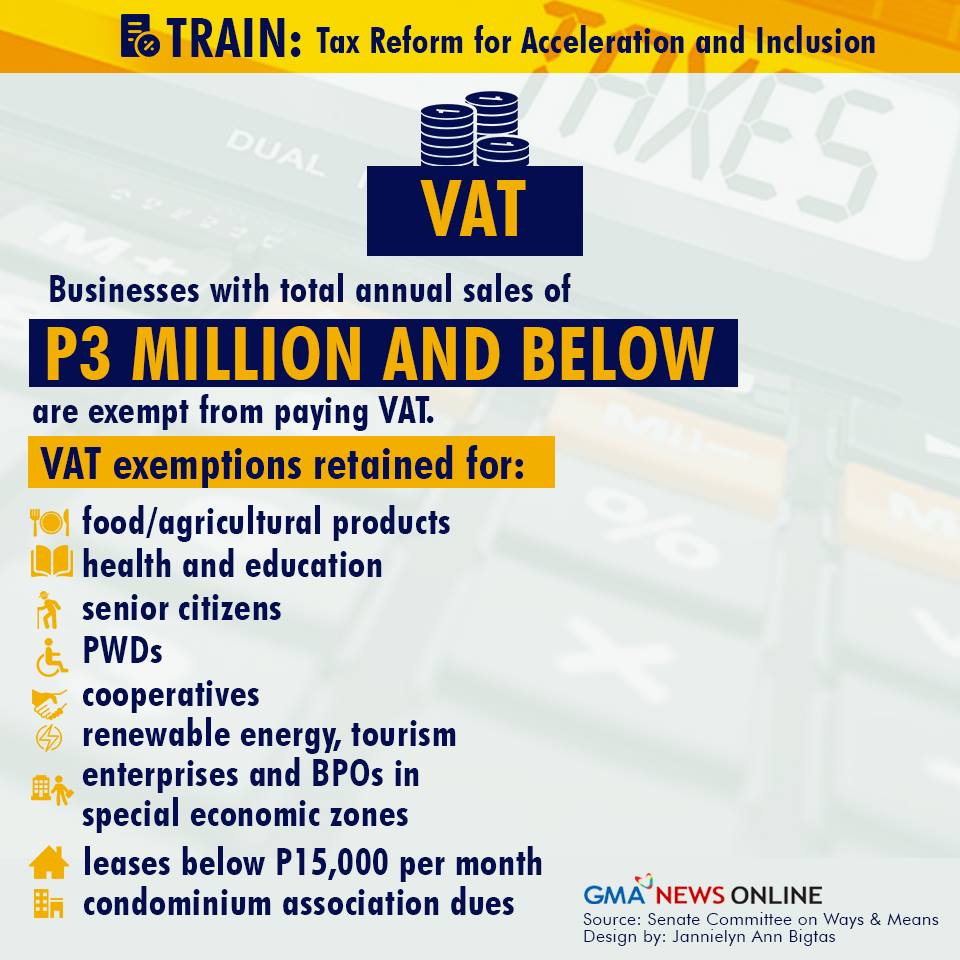

Rodrigo duterte on december 19 2017the tax implementation of train began on january 1 2018. Tax reform for acceleration and inclusion train by using this website you. If annual gross sales or income is p3 million or below. Revised income tax table for individuals.

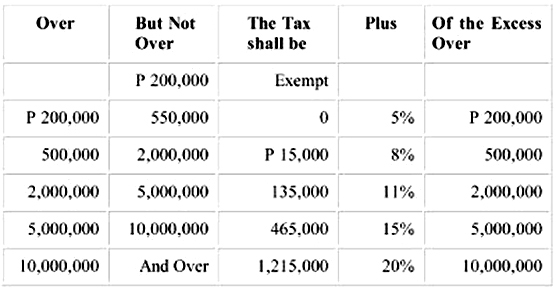

As such the withholding tax to be withheld by the employer shall be p101660. Self employed and professionals with annual gross sales or income receipts not exceeding the vat threshold of p3 million have the option to choose between these two tax rates. Seps whose gross salesreceipts and other non operating income do not exceed ph. 10963 or the tax reform for acceleration and inclusion train bill aiming to earn revenues to fund the countrys infrastructure program.

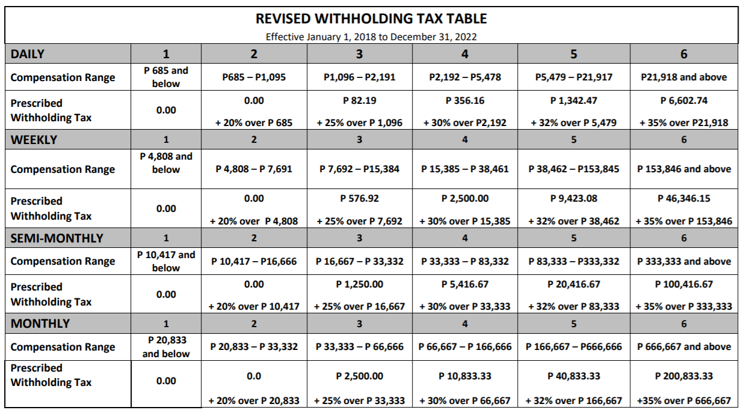

Under the train law the compensation range that is not subject to tax has been increased to p2083300 for monthly paid employees. 10963 self employed individuals and professionals will be subjected to the following tax regulations. We explain them in detail below. In this article we focus on the approved personal income tax ratesbelow youll find the new income tax tables to be adopted by the bureau of internal revenue bir when.

10963 train law digest full text. By using the semi monthly withholding tax table the withholding tax beginning january 2018 is computed by referring to compensation range under column 2 which shows a predetermined tax of p000 on p1041700 plus 20 of the excess of compensation range minimum amounting to p508300 p1550000 p1041700 which is p101660. The philippine tax reform bill known as train or tax reform for acceleration and inclusion was signed into law by pres. The relevant tax rules and sample computations are contained in in revenue regulations of the bureau of internal revenue rr 8 2018.

It is a method of collection of tax thats supposed to be paid to the government. While reading this you may want also to consider calculating your income tax base on your actual salary. Withholding tax is not a tax. P3m new vat threshold may opt to be taxed at.

Prescribes the policies guidelines and procedures in the availment of the eight percent 8 income tax rate option for individuals earning from.