Tax Table Train Law Philippines

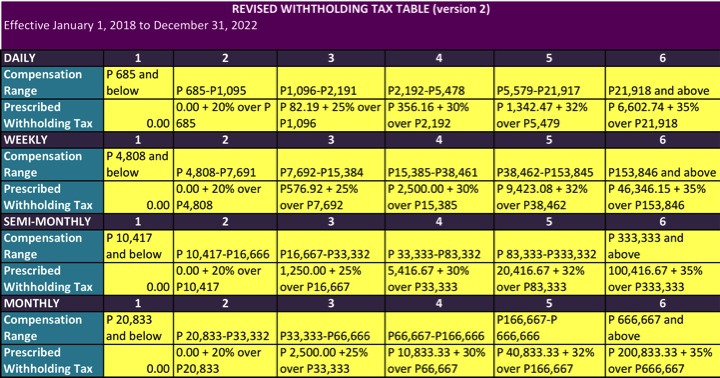

1 tax due from compensation computed using the graduated income tax rates.

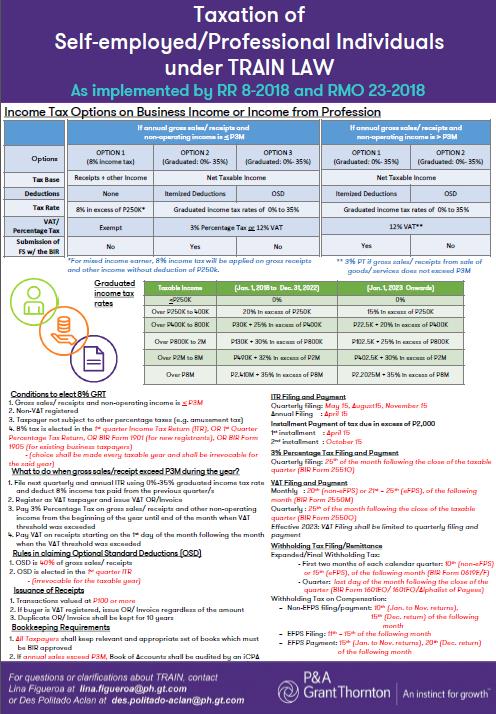

Tax table train law philippines. Rodrigo duterte on december 19 2017. 10963 otherwise known as the tax reform for acceleration and inclusion train act the first package of the comprehensive tax reform program ctrp on december 19 2017 in malacanang. Tax payments related to the taxpayers business or profession except for the income tax estate tax donors tax etc. And 2 tax due from self employmentpractice of profession resulting from the multiplication of the 8 income tax rate with the total of the gross sales receipts and other non operating income.

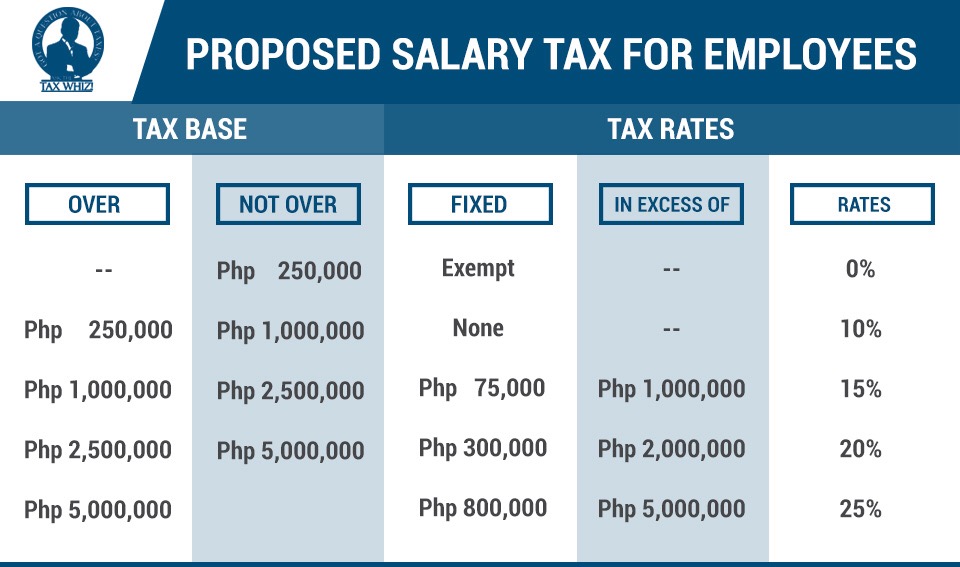

It provides for the increase in take home pay of salaried filipino by reducing income tax rates while increasing and rationalizing tax rates in other goods and services. How to compute income tax under train law useful wall last modified on april 23rd 2020 tax no comments with the implementation of the tax reform for acceleration and inclusion train law majority of workers or taxpayers in the philippines are experiencing reduction of the individual income tax in their monthly salary. More bir issues first circular on the revised withholding tax table implementing ra 10963. Train law also provides uniform tax rates for.

It allows more individuals to be exempted from tax. President rodrigo roa duterte signed into law republic act no. Implementation of the new taxation under train begun on january 1 2018 after being signed into. The bir is fast tracking the finalization of revenue issuances that will provide the guidelines for the implementation of tax reform for acceleration and inclusion train act.

This tax reform changed the personal income tax rates and thresholds to be exempted. The tax implementation of train began on january 1 2018. More individuals benefited from this tax system including those who are employed at the same time having mixed incomes. The effect of train law on the philippine tax system had a high impact on our tax systems.

Formula based on official bir tax tables. Losses from the normal operation of the business sale of capital assets etc. 271217 the tax reform for acceleration and inclusion train act. 2020 philippines bir train withholding tax calculator for employees.

We summarize below a list of revised and brand new taxes that are part of the approved tax reform for acceleration and inclusion or train law initiated by the department of finance dof and ratified by congress. The philippine tax reform bill known as train or tax reform for acceleration and inclusion was signed into law by pres.