Present Value Of Annuity Table

Present value of an annuity.

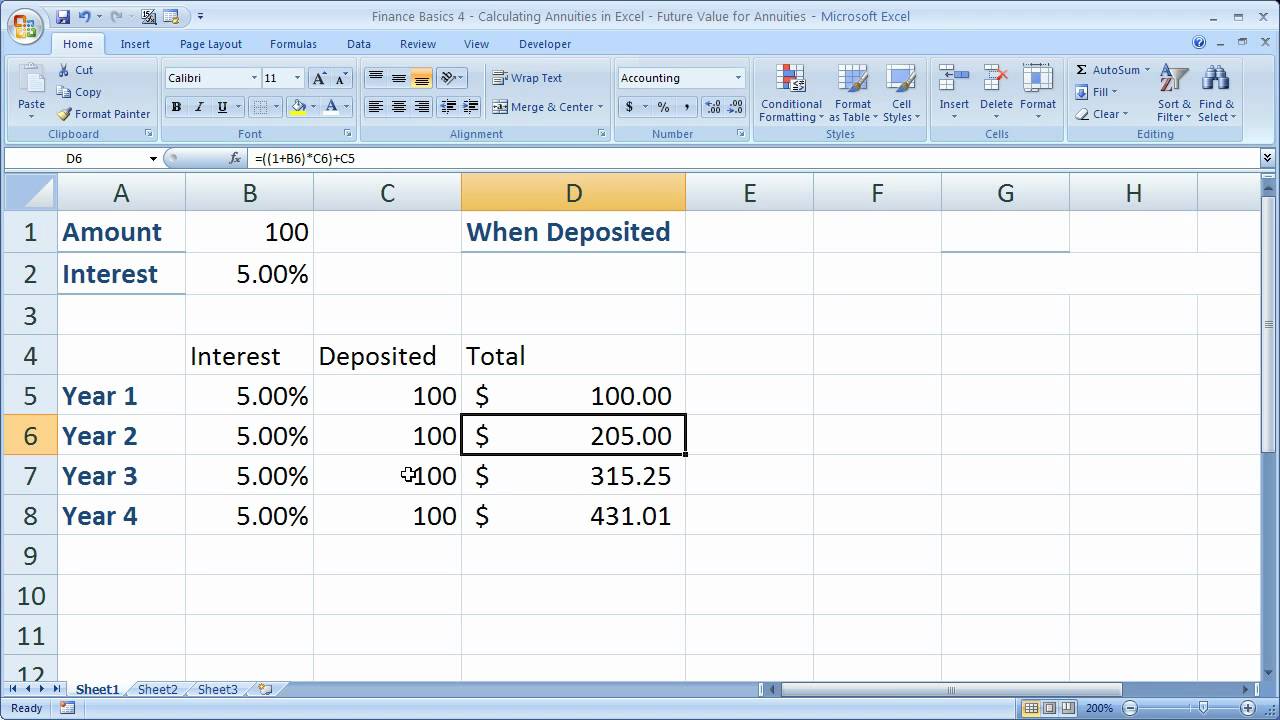

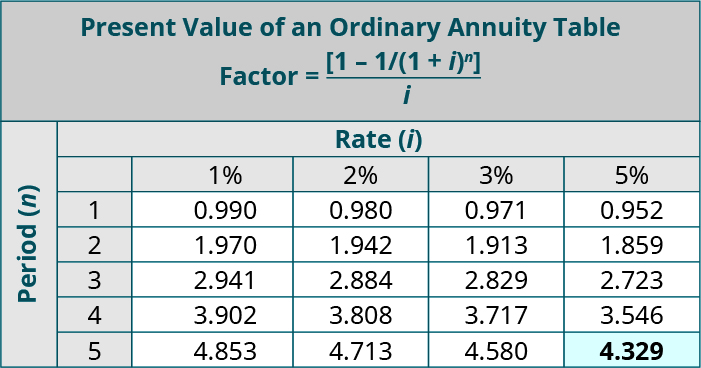

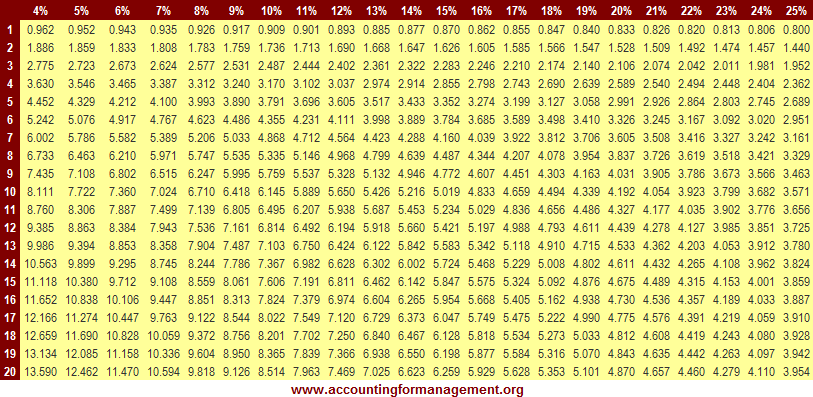

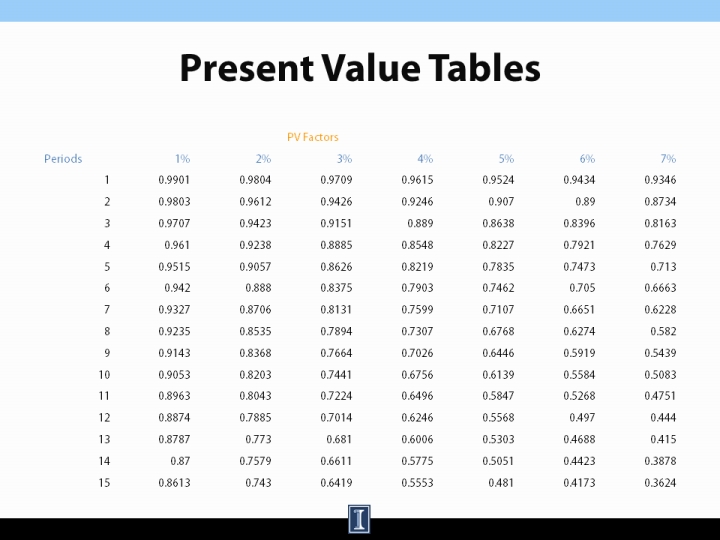

Present value of annuity table. Present value of annuity table. The future cash flows of. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Pv pmt x present value annuity factor present value annuity table.

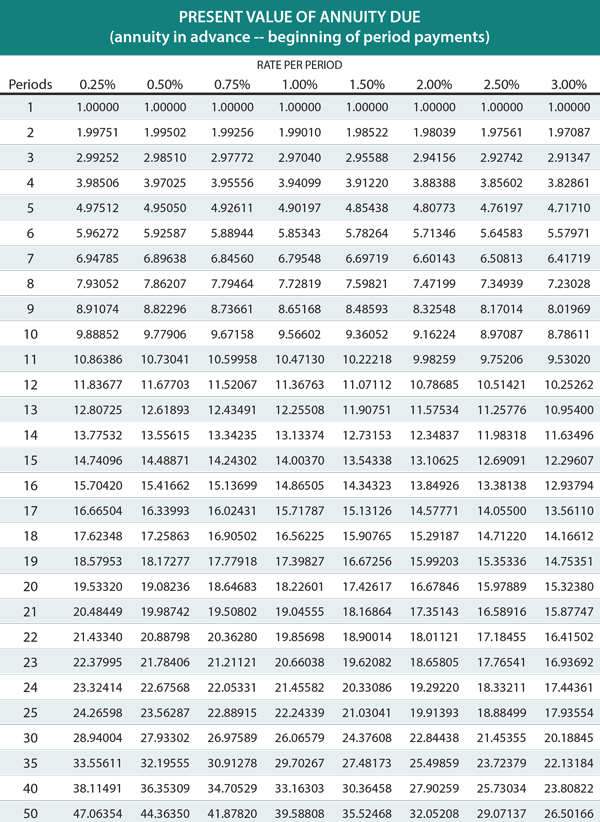

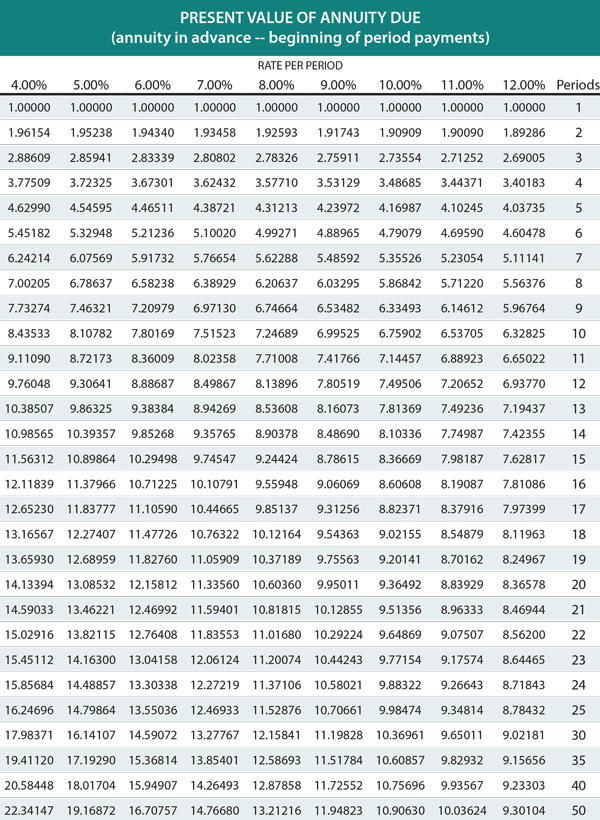

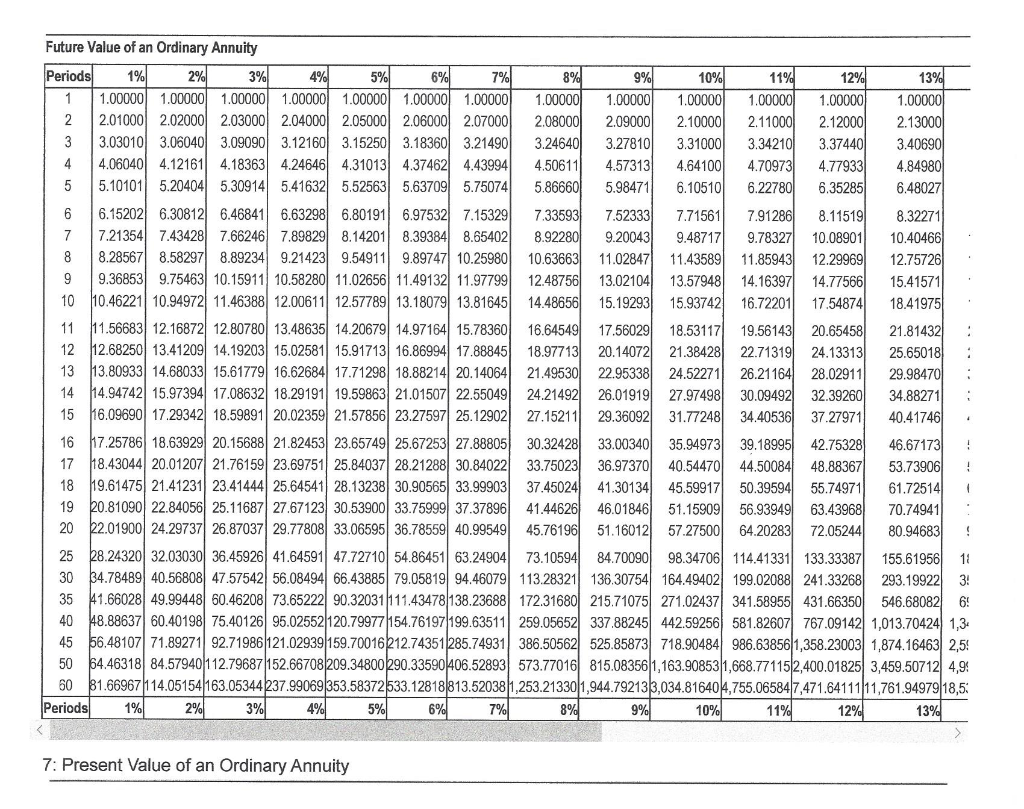

Present value table. The following present value of annuity table 1 per period n at r for n periods will also help you calculate the present value of your ordinary annuity. Present value annuity due tables download. Present value of 1 that is where r interest rate.

The present value annuity due tables are available for download in pdf format by following the link below. The present value annuity due factor of 74632 is found using the tables by looking along the row for n 9 until reaching the column for i 5 as shown in the preview below. Present value of annuity calculation. For example an annuity table could be used to calculate the present value of an annuity that paid 10000 a year for 15 years if the interest rate is expected to be 3.

The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. Below you will find a common present value of annuity calculation. This is the present value per dollar received per year for 5 years at 5. When you multiply this factor by one of the payments you arrive at the present value of the stream of payments.

Studying this formula can help you understand how the present value of annuity works. As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula. By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295. Pv pmt x 1 1 1 i n i present value annuity tables are used to provide a solution for the part of the present value of an annuity formula shown in red this is sometimes referred to as the present value annuity factor.

For example youll find that the higher the interest rate the lower the present value because the greater the discounting. The present value of an annuity formula is. 1 r n periods interest rates r n. N number of periods until payment or receipt.

Therefore 500 can then be multiplied by 43295 to get a present value of 216475.