Earned Income Tax Credit Table

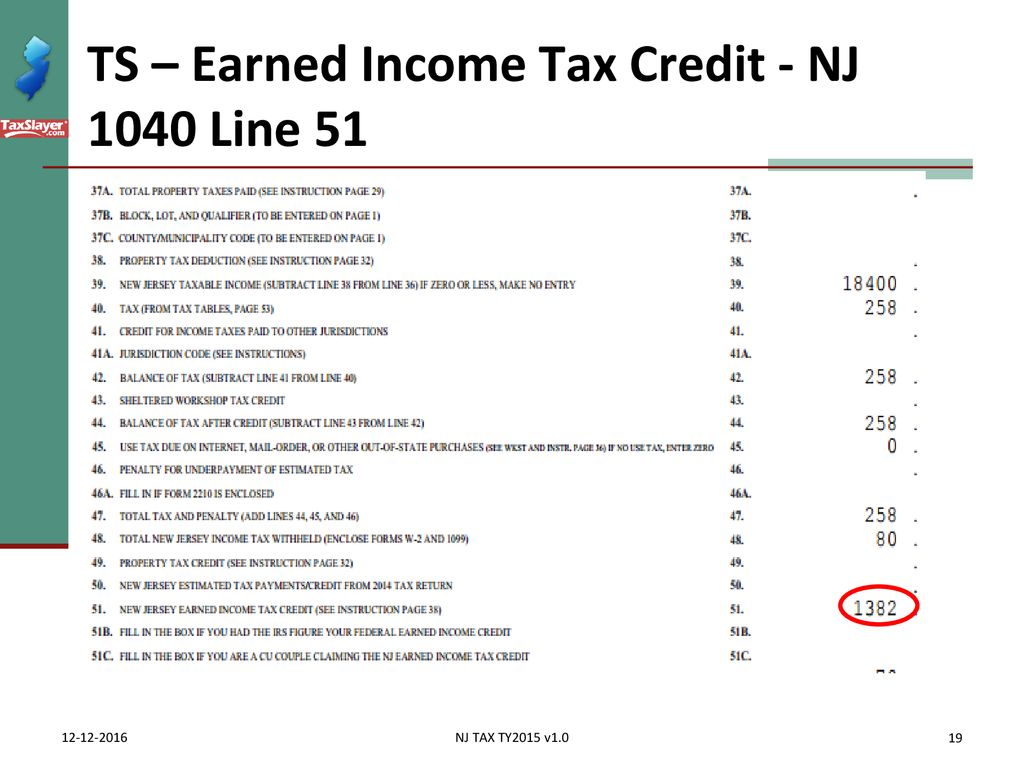

Eitc reduces the amount of tax you owe and may give you a refund.

Earned income tax credit table. What are medical expense tax deductions. The eic may also give you a refund. The earned income credit eic is a tax credit for certain people who work and have earned income under 55952. See the earned income and adjusted gross income agi limits maximum credit for the current year previous years and the upcoming tax year.

What are the irs tax refund cycle chart dates. What is the irs mileage rate for 2020. Earned income credit eic table. What is the irs dependent exemption.

Can i claim the eic. A tax credit usually means more money in your pocket. It reduces the amount of tax you owe. The eic may also give you a refund.

It reduces the amount of tax you owe. Federal solar energy tax credit. The earned income credit eic is a tax credit for certain people who work and have earned income under 55952. This booklet does not contain any tax forms department f ohe.

Read more in the earned income section of publication 596 earned income credit pdf. To claim the eic you must meet certain rules. The earned income tax credit eitc or eic is a benefit for working people with low to moderate income. Also in figuring earned income do not subtract losses on schedule c c ez or f from wages on line 7 of form 1040.

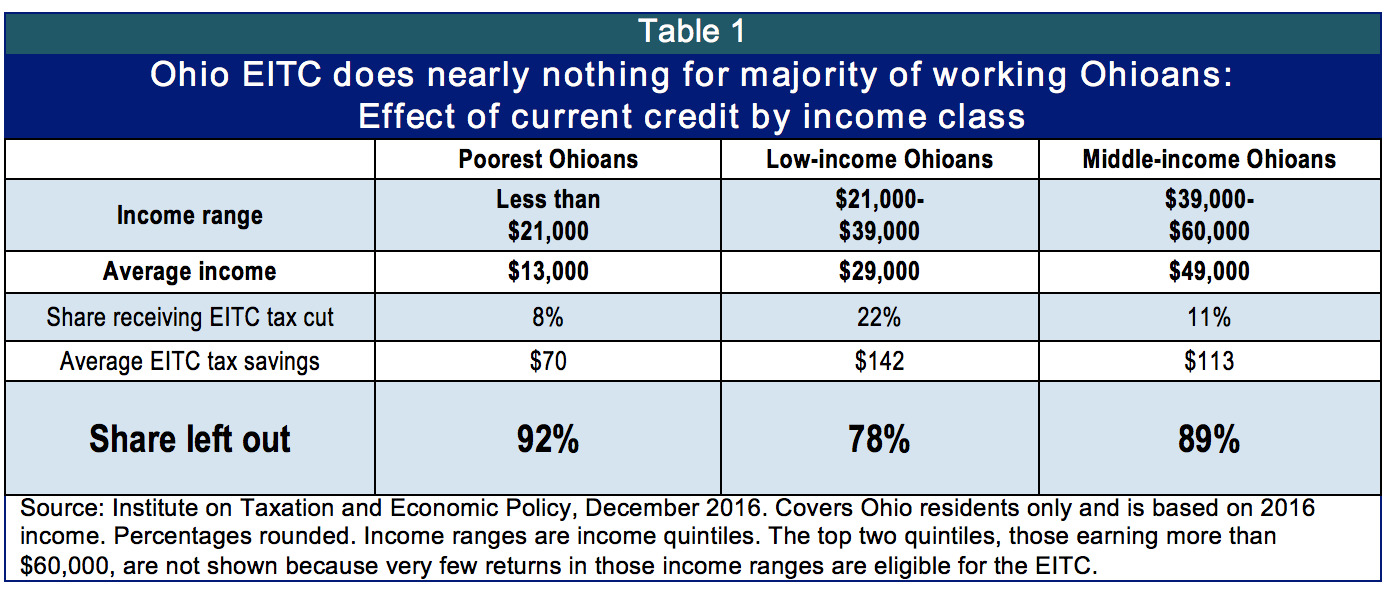

These rules are summarized in table 1. See the eic earned income credit table amounts and how you can claim this valuable tax credit. What is an education tax credit. When will turbotax send my tax.

However amounts you received as a self employed individual do not count as earned income. It s fast simple and secure. Tax year tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr. 2019 earned income credit 50 wide brackets 61219 if the if the if the amount you and you listed amount you and you listed amount you and you listed are looking up are looking up are looking up from the one two three no from the one two three no from the one two three worksheet is child children children children worksheet is child children children children worksheet is.

The earned income tax credit is available to claim for the 2019 2020 tax season. New child tax credit changes by irs. Freefile is the fast safe and free way to prepare and e le your taxes. To qualify you must meet certain requirements and file a tax return even if you do not owe any tax or are not required to file.

1040 tax and earned income credit tables introductory material 1040 tax and earned income credit tables main contents tax table.