2015 Irs Tax Tables

Tax tables form 1040 instructions html.

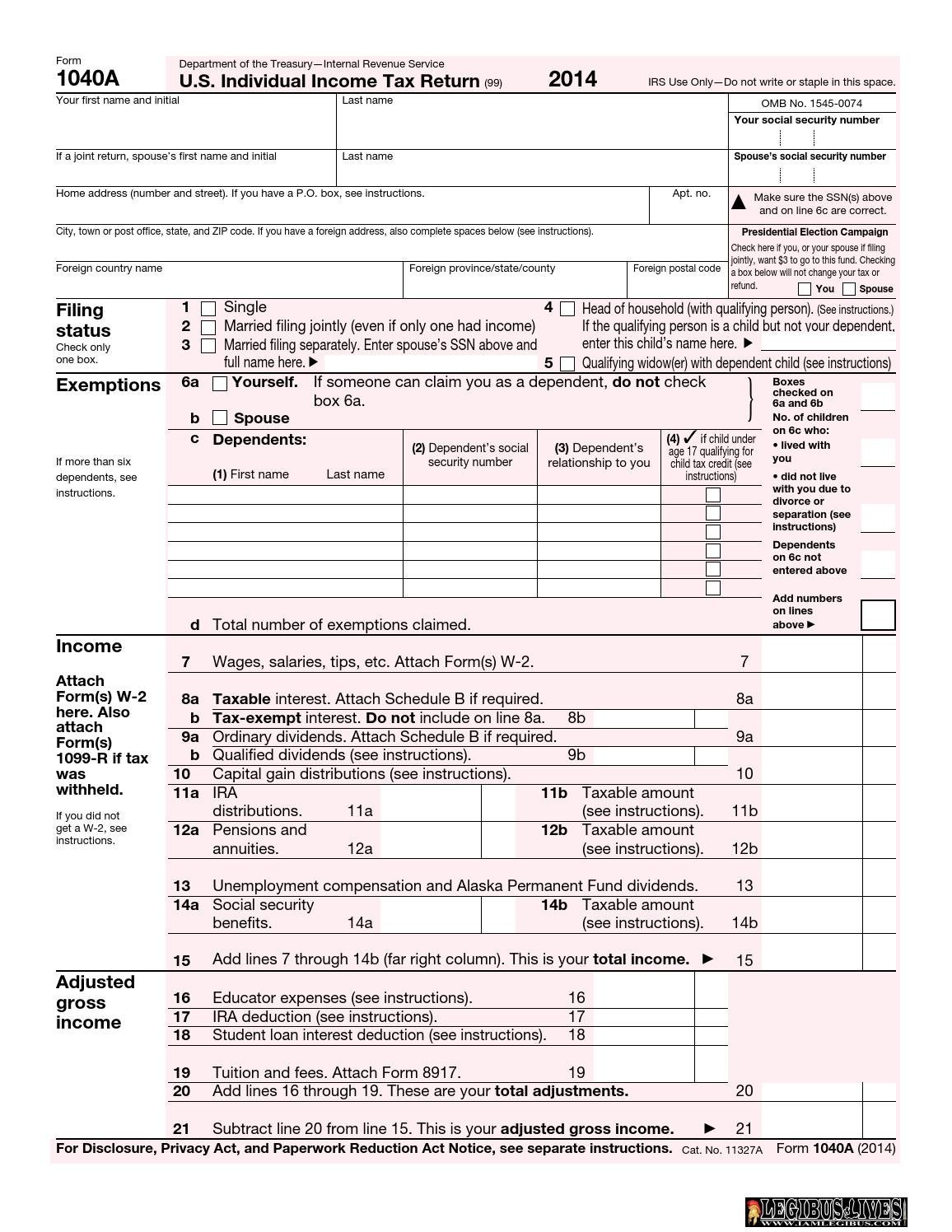

2015 irs tax tables. Ionsi10402015axmlcycle12source 1309 5 jan 2016 the type and rule above prints on all proofs including departmental reproduction proofs. See the instructions for line 44 to see if you must use the tax table below to figure your tax. Instructions on how to file a 2015 irs or state tax return are outlined below. You may benefit from filing form 1040a or 1040 in 2015 due to the following tax law changes you may benefit from filing form 1040a or 1040 even if you normally file form 1040ez.

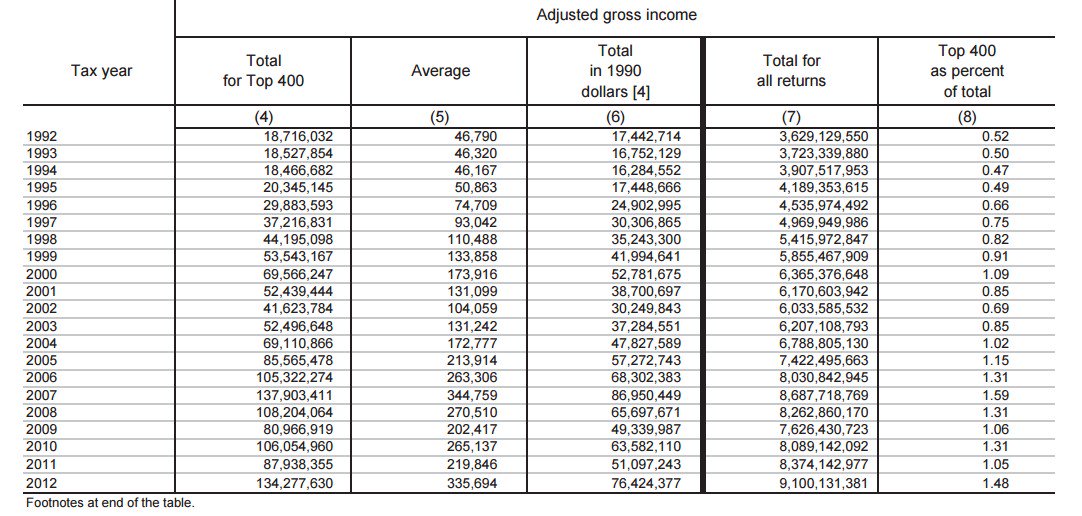

Individual income tax return. Tax table and tax rate. See the instructions for lines 8a and 8b. This is done to prevent what is called bracket creep this is the phenomenon by which people are pushed into higher income tax brackets or have reduced value.

You can no longer e file a 2015 federal or state tax return anywhere. Prior year tax tables forms and instructions. Individual income tax return. Instructions for form 1040 us.

This booklet does not. It s fast simple and secure. Tax year tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr. 2015tax table see the instructions for line 44 in the instructions for form 1040 to see if.

Prepare and e file your 2019 taxes by april 15 2020. For one child the credit is 3359 two children is 5548 and three or more children is 6242. Forms web links. 2015s maximum earned income tax credit for singles heads of households and joint filers is 503 if the filer has no children table 6.

Last week the irs released its calculation of the 2015 tax brackets and other parameters. Freefile is the fast safe and free way to prepare and e le your taxes. For tax year 2015 which americans must file by april 18 2016 the has announced annual inflation adjustments for more than 40 tax provisions. Page 78 of 105 fileid.

Figuring the eic on either your original or an amended 2015 re turn even if that child later gets an ssn. Every year the irs adjusts more than 40 tax provisions for inflation.